Contents:

Some will buy the point of the flag break, some ahead of the flag break, some well after its broken out and on pull-backs and replacements. It’s a very common pattern, so you’re bound to see them in action on any given trading day. At a lower volume, the cryptocurrency consolidates near the top of the pole to produce the flag.

The bull flag trading strategy pattern is the absolute opposite of the Bear Flag pattern in appearance. The pattern begins with a bullish trending move, which then pauses and turns into a minor bearish correction. The tops and the bottom of this correction are parallel as well.

What Is A Bull Flag? Pattern Trading and Strategies

It’s easy to spot them in hindsight but much harder in the moment. Last, you’ll see an end to the selling and the buyers will take charge once again. Endurance is one of the most important qualities of a trader.

The efficient markets hypothesis , also called the Random Walk Theory, is the idea that current securities prices accurately reflect the information about the firm’s value. Therefore, it is impossible to make excess profits using this information, or gains that are greater than the overall market. Of course, a bullish flag pattern may not always break higher, and other news or factors may change the outcome, so other technical indicators and analyses can be beneficial. Also, you should always think about the bigger picture of the market and be aware of any fundamental factors that may be driving demand at that time. In day trading, the Bull Flag pattern is a fast execution trading strategy that works best on stocks with low float.

The value of an investment in stocks and shares can fall as well as rise, so you may get back less than you invested. This strategy hardly defines the Take-Profit level. Still, you can use the rule applied in Strategy 1. Measure the distance between the start of the trend and the consolidation. The Stop-Loss order should be placed below the support line of the bull flag.

Then you want a tight https://g-markets.net/ where the price begins to move downward or countertrend on lower volume. Lastly, when the volume returns, you’ll buy the break of the previous candle’s high. This sounds very simple, but it takes a trained eye to really see the quality of the bull flag. As a breakout strategy, you want to make sure that you respect your stops and analyze the price and volume well. Similarly, you want to make sure you are trading off of the correct time frame for the context of the move. The best way to view them is using a candlestick chart.

Note the strong rise in the stock as it forms the flag pole, and the tight consolidation that follows. Bulls are not waiting for better prices and are buying every chance they get. The bull flag pattern is considered to be a bullish pattern, as it suggests that the price will continue to move higher after the consolidation period. Traders often look for this pattern as a potential buying opportunity, as it can indicate that the trend is still strong and that the price may continue to rise.

The breakout from the bull flag often sees another increase in volume, although volume may not increase dramatically. Also, traders can ascertain the bull flag profit target by calculating the price distance between the base of the flagpole and the flag’s highest point. The simple bull flag guidelines here accommodate a wide range of continuation patterns.

Bull Flag Candlestick Pattern

As such, the volume is upwards as the remaining investors feel compelled to take action. Once you understand how the bull and bear flags work, it will be easy to identify them. In a bullish flag pattern, you will need to identify the initial price increase, referred to as the flagpole. Following the initial price increase is the period of consolidation, during which prices may move slightly downward or sideways.

A bullish flag pattern is subjective and different traders can see different patterns in the charts. Therefore, traders must trust their analysis to minimize stress and follow their trading rules. This pattern usually means that the market is very bullish, potentially because of new information and that the asset will likely go up shortly. Traders will exit losing short positions should the uptrend channel line be broken, along with new buy entry orders from other traders. The support and resistance lines on a bull pennant flag will resemble a cone.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

As a general rule, the price of a T-bills moves inversely to changes in interest rates. See Jiko U.S. Treasuries Risk Disclosures for further details. As it reaches the endpoint, the price should break above the top boundary of the flag pattern. As the pattern is retraced, the line should not move below half of the pole. If it does, it’s not considered a flag trading pattern. A doji is a trading session where a security’s open and close prices are virtually equal.

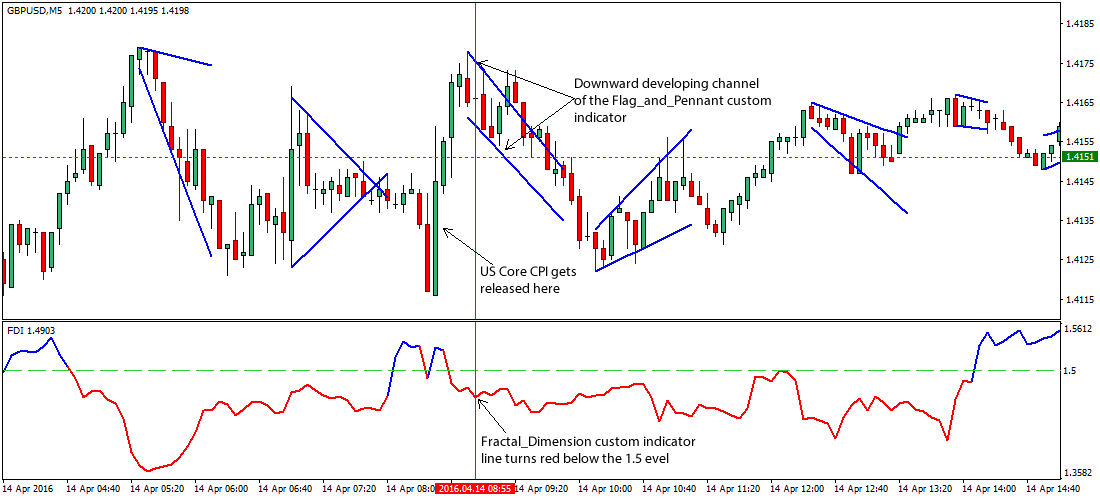

How to trade the flag pattern

Notice that the Flag Pole is in a bearish direction. Upon breakout of the lower channel line, we expect to see a continuation of the prevailing bearish trend. After creating the pole, a valid Flag pattern will then begin to trade within a tight range, taking on the shape of a Flag. The Flag consists of price action with evenly distributed tops and bottoms.

When looking at the flag on smaller time intervals, traders risk making mistakes in setting the stop-loss – the bullish flag sometimes gives false breakout point signals. Therefore it’s crucial to continuously educate yourself and seek independent advice if necessary. In common words, the bull flag pattern appears due to a pause in the uptrend. It’s the time of price consolidation, after which the price continues to move up. A bullish flag pattern is a flag pattern that occurs during an uptrend and signals a potential continuation of the upward momentum.

Backtest Every Strategy

You could, for instance, move both your stop and take profit as the market approaches the first profit target. Discover the range of markets and learn how they work – with IG Academy’s online course. This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. In a hot market, a flat top breakout is worth a shot … as long as you remember to cut those losses. And after the fakeout, it fizzled out and cracked under the stop.

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Gold/Silver: Reduce exposure, raise stops and buy the dip – Kitco NEWS

Gold/Silver: Reduce exposure, raise stops and buy the dip.

Posted: Fri, 24 Mar 2023 07:00:00 GMT [source]

The length of the pattern can be different depending on the time period. Successful traders use technical analysis tools to analyze assets’ past performance and try to predict the duration of the pattern. The aim of this article was to study in detail the flag patterns, their main advantages and disadvantages.

What You Should Know About a Bull Flag Pattern

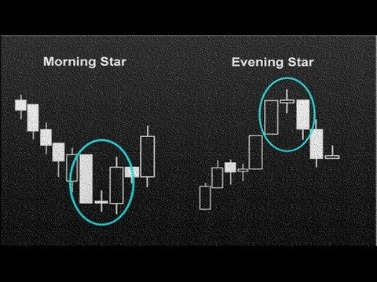

Bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations. In this article we look at how to trade these opportunities. Another pattern that resembles the bullish flag pattern is called a pennant. Instead of developing parallel lines to form the flag, the lines converge during the consolidation period.

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

This will remain until the asset sees a breakout to the upside. In contrast to a bearish channel, this pattern tends to be short-term and indicates that buyers will need a break. In most cases, descending flags show a continuation pattern. Cryptocurrency traders use technical analysis as a guide to managing their trades.

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. But after the examples above, you should be familiar with our bull flag guidelines.